Understanding

DRS Scheme

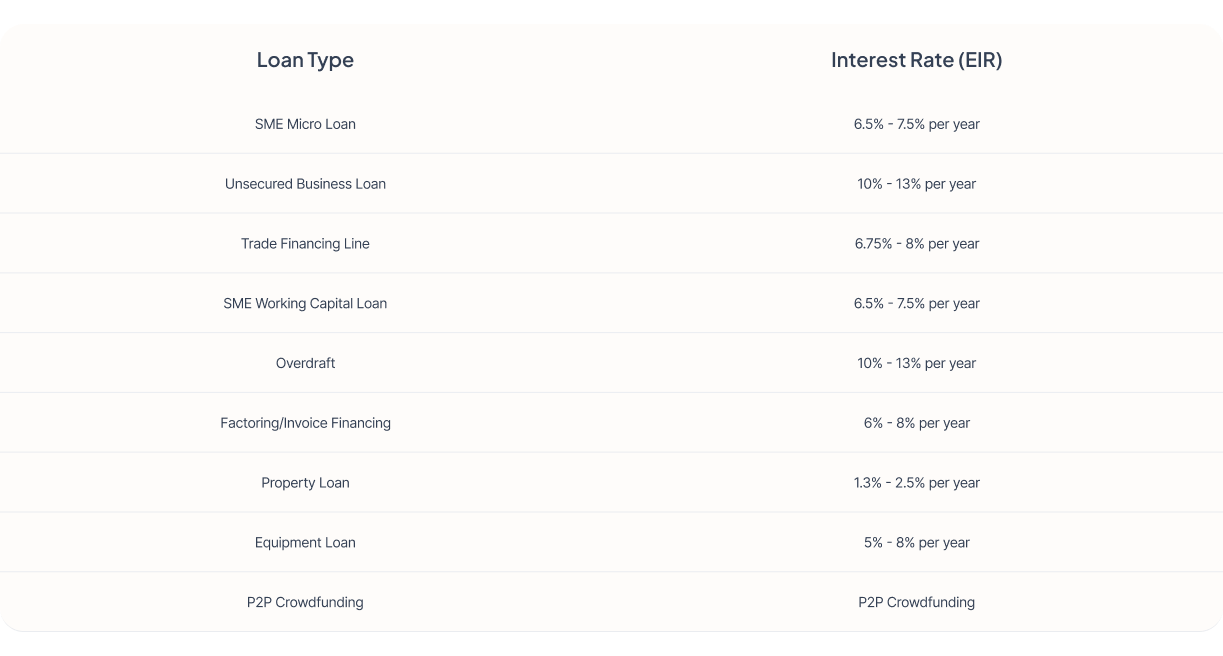

LoanOwl is a online business financing portal – we work with banks, accredited lenders and other financing institutions to obtain working capital for your business. With extensive experienced servicing SMEs and Businesses across all industries we are better able to provide you financing solutions quickly and easily – and at a low cost.

For a financing specialist to contact you for a no obligation discussion, please click here.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)